Simple steps to onboarding new merchants

Onboarding new merchants is a requirement for businesses that accept credit card payments. Merchant onboarding connects new card-accepting companies with an approved payment provider.

The process is necessary for merchants to establish a relationship with the payment provider and ensure that debit and credit card payments are accepted and processed securely.

For independent sales organizations (ISOs, onboarding is necessary to build a successful portfolio of merchants. The process established trust and credibility, allowing ISOs to provide a reliable service for their customers.

Businesses use onboarding to access cards and other processing methods so their companies can accept payments for their services.

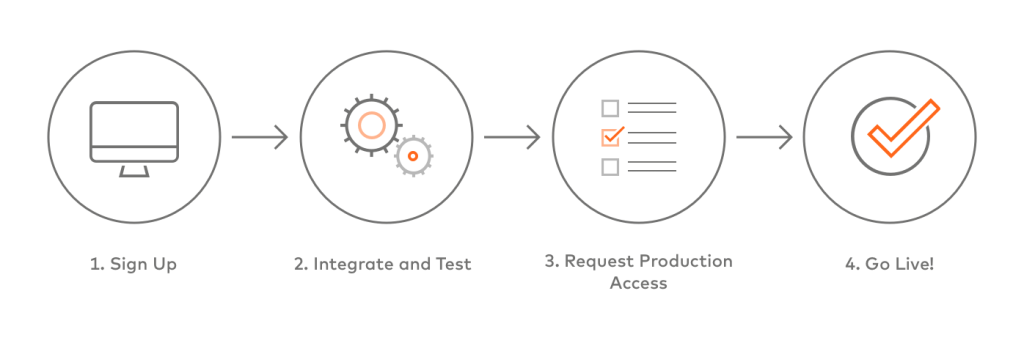

Now that you know why the merchant onboarding process is a crucial part of connecting payment service providers with businesses, here’s how to complete the process.

Steps Involved In The Process

Even though all businesses are unique, the steps for merchant onboarding are the same.

- Pre-screening: The merchant service provider will typically conduct an initial pre-screening of the business to assess the potential risk and determine if the merchant is a good fit for their services.

- Identity checks: Also referred to as “Knowing Your Customer,” this “KYC” step involves verifying the identities of all individuals involved in the merchant’s business. This includes obtaining government-issued identification such as a passport or driver’s license, as well as proof of address.

- Underwriting: The merchant underwriting process involves assessing the candidate’s creditworthiness, financial stability, and business history to determine the risks involved with providing payment services to the merchant.

- Merchant history screening: This step involves reviewing the merchant’s past credit card processing history to identify any potential red flags, such as high chargeback ratios or payment fraud.

- Compliance setup: Once the merchant has been approved, the provider will help the business design its payment environment to ensure that it complies with industry regulations and standards.

Why do you want to complete the merchant onboarding process? The process not only establishes a relationship built on trust between merchant and payment service providers, but it also helps ensure you are meeting regulatory requirements.

Documents Necessary for the Process

You can’t accept a business’s word that they are precisely what they say. The business must provide the following documentation. As the payment service provider, it’s up to you to perform due diligence. This isn’t something you want to overlook. Failing to verify the business’s information can result in hefty regulatory fines and other penalties.

- Proof of identity for all individuals involved in the company

- Proof of address (i.e., utility bill or lease agreement)

- Registration documents based on the type of business, such as incorporation papers or registration certificates

- Income tax returns for the previous year(s)

- Salary slips to verify employment

- Bank statements to verify financial stability

In most cases, a simple online search is all that’s necessary to verify the supplied information. Most countries also have a list of businesses licensed to operate within their borders.

While the onboarding process is the same, regardless of country, it’s also a good idea to check with local finance laws. These can change depending on the country.