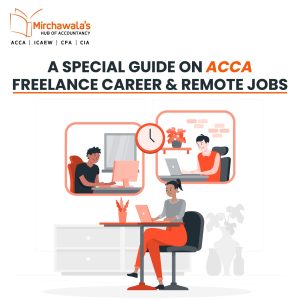

A Special “Read” to Guide You on ACCA Freelance Career and ACCA Remote Jobs

In the present dynamic job market, traditional career pathways are changing. Throughout this transition, freelancing has become a strong and adaptable substitute. The world of freelancing presents great opportunities for finance professionals with an ACCA qualification to utilize their experience, become financially independent, and build a rewarding career on their terms.

Before we move into the best freelancing jobs in ACCA or how to grow as a freelancer in ACCA, let’s first understand the current finance market.

Navigating the Freelance Finance Market

The freelance finance industry has changed dramatically in the last few years, offering ACCA professionals a wide range of interesting prospects. The demand for talented freelancers has increased as firms shift more and more toward project-based partnerships and specialized knowledge. Due to this change, ACCA professionals can now operate on a global scale and provide their financial expertise to clients across large geographic distances.

Tips on Successful ACCA Remote Job or Freelancing

Here are some effective tips to help you make your career successful with an ACCA freelance job:

- Creating a Powerful Online Identity:

Your internet presence acts as the virtual front entrance to your ACCA freelance job in the digital age. Create a polished website that emphasizes your special selling point in addition to showcasing your ACCA credentials. Ensure that your website is user-friendly, and aesthetically pleasing, and provides simple access to your portfolio, services, and contact information. In addition to increasing your credibility, a well-designed website makes it easier for potential customers to find you.

- Harnessing the Freelance Platforms

These platforms have emerged as essential tools for matching independent contractors with employers in need of their specialized expertise. Sites such as Upwork, Freelancer, Toptal, and others offer an organized setting where you may offer your services, bid on jobs that interest you, and establish a name for yourself through customer testimonials.

- Creating an Eye-Catching Profile

Your internet profile serves as a digital introduction to prospective customers. Make it worthwhile! Make sure to include secondary keywords like “financial consultancy,” “audit expertise,” and “taxation services” wisely, and emphasize your ACCA qualification prominently. Give a thorough rundown of your qualifications, expertise, and previous work. Consider providing case studies or success stories that demonstrate your capacity to deliver results.

- Using Networks to Your Advantage

Even if the internet world has a ton of chances, networking in the real world is still quite important. Attend seminars, workshops, and webinars about accounting, finance, and auditing. These gatherings offer a forum for networking with possible customers, partners, and other independent contractors.

- Understanding Customer Relations

Successful freelance work is mostly dependent on effective communication. Communicate with prospective customers in a straightforward, succinct, and timely manner. Make sure you fully comprehend their needs and adjust your proposals to meet them. Explain to them how your ACCA certification and experience would benefit their initiatives.

Consider Freelance Financial Consultancy:

In the ACCA freelance world, one of the most in-demand services is financial consulting. Providing professional analysis, guidance, and recommendations to people and corporations looking to maximize their financial strategies, reduce risks, and reach their financial objectives is known as financial consulting. Because they have a thorough understanding of financial concepts, regulatory frameworks, and industry best practices, ACCA experts are incredibly well-suited for this function. As dependable counsel, freelance financial consultants provide insights that help boost operational effectiveness and financial growth.

Key Responsibilities of a Freelance Financial Consultant

- As a freelance financial consultant, you need to evaluate organizations’ financial well-being, examine performance indicators, and create thorough financial strategies.

- Freelancers with ACCA certifications help with risk identification, risk management strategy development, and regulatory compliance.

- Your knowledge will be evident when you advise customers on tax planning, optimization, and compliance, assisting them in minimizing their tax obligations while adhering to the law.

- Professionals in ACCA accounting may help companies prepare transparent, accurate financial accounts that adhere to applicable accounting standards.

Although the flexibility of freelancing is its primary benefit, it also necessitates effective time management and self-control. It takes careful preparation to manage several clients, deadlines, and personal time. We at Mirchawala’s Hub of Accountancy are here to support you every step of the way. Our uniquely crafted courses provide you with the knowledge and real-world experience required to succeed as a self-employed financial advisor.

Additionally, Mirchawala’s hub of accountancy gives you the chance to join the expert faculty and helpful community that is always there to help you on your learning path.